Struggling with finances is a common predicament for many, but somehow, broke people always manage to find a way to afford certain things that others might find extravagant. In this article, we will delve into the mysterious world of broke people’s spending habits and reveal how they always seem to scrape together enough money for these ten things.

From the latest tech gadgets to luxury vacations, we will uncover their secrets and shed light on their ingenious money-saving strategies.

Whether it’s the art of couponing, mastering the art of DIY, or simply knowing where to look for the best deals, broke people have developed unique approaches to stretch their budgets and fulfill their dreams. By understanding their tactics, we can all learn a thing or two about making the most of our own financial situation.

Join us as we unveil the hidden paths broke people take to afford these indulgences. Get ready to unlock the secrets behind their wizardry and gain insights that can transform the way you approach your own personal finances.

Money Master the Game

by Anthony Robbins

⏱ 15 minutes reading time

🎧 Audio version available

Prioritizing essentials: How broke people always find money for basic needs

Broke people have mastered the art of prioritizing their essential needs. They understand that while indulgences can be tempting, it’s crucial to prioritize necessities first. From housing and food to utilities and transportation, they ensure that these basic needs are met before allocating any funds to other expenses.

One of the tactics broke people use is to carefully evaluate their spending habits and identify areas where they can cut back. They may opt for more affordable housing options, choose generic brands at the grocery store, or utilize public transportation instead of owning a car. By making these conscious choices, they free up money that can be redirected towards other expenses.

Another strategy broke people employ is to take advantage of government assistance programs or community resources that can help alleviate the burden of essential expenses. They are proactive in seeking out available support, such as food banks, housing assistance, and utility bill payment assistance. By tapping into these resources, they are able to stretch their limited funds further.

Finding innovative ways to reduce costs is also a key aspect of how broke people always manage to find money for basic needs. They may negotiate lower rent or utility bills, shop at thrift stores, or participate in clothing swaps with friends and family. Additionally, they are diligent about comparison shopping and looking for the best deals, whether it’s through online platforms or physical stores.

Broke people prioritize their essential needs, evaluate their spending habits, take advantage of government assistance programs and community resources, and find innovative ways to reduce costs. These strategies allow them to consistently find money for basic necessities, even when funds are tight.

Budgeting hacks: Strategies for making the most of limited funds

Budgeting is a crucial skill that broke people have mastered to make the most of their limited funds. They understand that every dollar counts and that careful planning is essential for financial success. By implementing various budgeting hacks, they ensure that their money is allocated wisely and that unnecessary expenses are minimized.

One budgeting strategy that broke people employ is the envelope system. They divide their income into different envelopes, each representing a specific expense category, such as groceries, utilities, transportation, and entertainment. By physically allocating cash into these envelopes, they have a clear visual representation of how much money they have left for each category, making it easier to stick to their budget.

Another budgeting hack broke people use is the 50/30/20 rule. This rule suggests allocating 50% of income towards essential expenses, such as housing and utilities, 30% towards discretionary spending, such as dining out or entertainment, and 20% towards savings or debt repayment. By following this guideline, broke people ensure that they are prioritizing both their immediate needs and their long-term financial goals.

Tracking expenses is also a fundamental aspect of budgeting for broke people. They meticulously record every expense, whether it’s a small purchase or a significant bill payment. This allows them to see where their money is going and identify areas where they can cut back or make adjustments. There are various budgeting apps and tools available that make expense tracking more convenient and efficient.

Additionally, broke people understand the importance of setting realistic financial goals. By having specific targets in mind, such as saving a certain amount of money or paying off a certain debt, they stay motivated and focused on their financial journey. They break down their goals into smaller, achievable milestones and celebrate each milestone as they progress.

Broke people make the most of their limited funds by implementing various budgeting hacks. They utilize the envelope system, follow the 50/30/20 rule, track their expenses meticulously, and set realistic financial goals. These strategies empower them to optimize their budget and make informed decisions about their spending.

The power of saving: How broke people build an emergency fund

Building an emergency fund is an essential component of financial stability, and broke people understand its significance. Despite their limited funds, they prioritize saving and allocate a portion of their income towards building an emergency fund. This financial cushion provides peace of mind and acts as a safety net during unexpected situations.

Broke people start by setting a specific savings goal for their emergency fund. Whether it’s three months’ worth of expenses or a specific dollar amount, they have a target in mind that they work towards. They break down their goal into smaller, achievable milestones, which makes the process more manageable and less overwhelming.

To save money, broke people employ various strategies. They may cut back on discretionary expenses, such as dining out or entertainment, and redirect those funds towards their emergency fund. They also look for opportunities to increase their income, whether it’s through side hustles, freelance work, or selling unused items. Every dollar saved or earned is a step closer to their savings goal.

Automating savings is another tactic broke people use to build their emergency fund. They set up automatic transfers from their checking account to their savings account, ensuring that a portion of their income is consistently saved without requiring active effort. This removes the temptation to spend the money and makes saving a priority.

Broke people also take advantage of interest-earning savings accounts or other investment options to grow their emergency fund. They research and explore different financial institutions or investment platforms to find the best options that align with their goals. By maximizing the potential returns on their savings, they accelerate their progress towards building an emergency fund.

Broke people understand the power of saving and prioritize building an emergency fund. They set specific savings goals, employ various saving strategies, automate their savings, and explore investment options to grow their fund. By consistently working towards their savings goals, they create a financial safety net that provides stability and peace of mind.

Investing in education: Why broke people prioritize personal growth

Despite their financial constraints, broke people understand the value of investing in education and personal growth. They recognize that expanding their knowledge and skills can open doors to better opportunities and improve their financial situation in the long run. As a result, they prioritize personal growth and find ways to invest in their education.

One way broke people invest in education is by taking advantage of free or low-cost resources. They actively seek out educational content and resources available online, such as podcasts, YouTube tutorials, and ebooks. They also explore free or affordable online courses or webinars that offer valuable knowledge and skills relevant to their interests or career goals.

Additionally, broke people leverage community resources and organizations that provide educational programs or workshops. They participate in local community college classes, attend career development seminars, or join networking groups that offer educational opportunities. By tapping into these resources, they gain access to valuable learning experiences without breaking the bank.

Broke people also prioritize self-learning and personal development. They read books, listen to podcasts, and engage in activities that broaden their knowledge and perspectives. They understand that personal growth goes beyond formal education and that continuous learning is a lifelong journey.

Furthermore, broke people seek mentorship or guidance from individuals who have expertise in their areas of interest. They reach out to professionals or industry experts, seeking advice and learning from their experiences. By building relationships with mentors, they gain valuable insights and guidance that can accelerate their personal growth.

Broke people prioritize personal growth and invest in education despite their financial constraints. They take advantage of free or low-cost resources, leverage community resources, engage in self-learning, and seek mentorship. By continuously expanding their knowledge and skills, they position themselves for better opportunities and long-term financial success.

Health and wellness: How broke people prioritize self-care

Self-care is a crucial aspect of overall well-being, and broke people understand its importance. They prioritize their health and wellness despite financial constraints, finding affordable ways to take care of themselves physically, mentally, and emotionally.

Broke people prioritize preventive healthcare to avoid costly medical expenses down the line. They schedule regular check-ups and screenings, ensuring that any potential health issues are addressed proactively. They also take advantage of low-cost or free community health clinics or programs that provide essential healthcare services.

When it comes to physical fitness, broke people get creative with their exercise routines. They explore free workout videos available online, utilize community fitness centers or outdoor spaces, or engage in activities like walking or running that require minimal equipment or expenses. They understand that staying active doesn’t have to be expensive and that regular exercise is essential for their overall well-being.

Mental and emotional well-being are also prioritized by broke people. They find affordable or free ways to manage stress and take care of their mental health. This may involve practicing mindfulness and meditation, engaging in hobbies or creative outlets, or seeking support from free or low-cost counseling services. They understand the importance of nurturing their mental and emotional well-being, even when financial resources are limited.

Furthermore, broke people understand the value of a balanced diet and find ways to eat healthily on a budget. They prioritize nutritious, affordable food options and explore cost-saving strategies, such as meal planning, buying in bulk, or growing their own produce. By being mindful of their food choices and finding ways to save money, they maintain a healthy diet without overspending.

Broke people prioritize their health and wellness by seeking preventive healthcare, finding affordable ways to stay physically active, nurturing their mental and emotional well-being, and maintaining a balanced diet on a budget. They understand that self-care is essential for overall well-being and find creative ways to prioritize it, even when financial resources are limited.

Quality time with loved ones: Finding affordable ways to create memories

Spending quality time with loved ones is a priority for broke people, and they find affordable ways to create lasting memories without breaking the bank. They understand that experiences and connections are more valuable than material possessions and prioritize building strong relationships with their family and friends.

Broke people get creative with their activities and outings to ensure they can spend quality time with their loved ones without overspending. They explore free or low-cost community events, such as festivals, concerts, or outdoor movie screenings. They also organize potluck gatherings or game nights where everyone contributes, ensuring that the focus is on enjoying each other’s company rather than expensive outings.

Nature provides a cost-effective backdrop for creating memories, and broke people take advantage of outdoor spaces for their activities. They go on hikes, have picnics in the park, or spend a day at the beach. These simple yet meaningful experiences allow them to connect with their loved ones while appreciating the beauty of nature.

Broke people also prioritize open communication and honest conversations with their loved ones about their financial situations. By openly discussing their limitations and setting realistic expectations, they can find ways to spend quality time together that align with their financial capabilities. This fosters understanding and strengthens their relationships.

Additionally, broke people understand the power of homemade gifts and gestures. They may create personalized photo albums, write heartfelt letters, or prepare homemade meals as a way to show their loved ones how much they care. These gestures are often more meaningful than expensive gifts and create memories that last a lifetime.

Broke people prioritize spending quality time with loved ones and find affordable ways to create lasting memories. They get creative with their activities and outings, take advantage of outdoor spaces, prioritize open communication, and focus on homemade gestures. By valuing experiences and connections over material possessions, they cultivate strong relationships and create meaningful memories.

Building a support network: Leveraging community resources and connections

Broke people understand the importance of building a support network and leverage community resources and connections to navigate their financial challenges. They recognize that they don’t have to face their financial struggles alone and that there are resources and people available to help them along the way.

Broke people actively seek out community resources that can provide assistance or guidance. They research local organizations or non-profits that offer financial education programs, job placement services, or emergency financial assistance. By tapping into these resources, they gain access to valuable support and information that can help improve their financial situation.

Networking is another valuable tool that broke people utilize to build their support network. They engage with like-minded individuals who are facing similar financial challenges, whether it’s through online forums, local meetups, or support groups. By sharing experiences and learning from one another, they find encouragement and inspiration to navigate their financial journey.

Furthermore, broke people understand the power of mentorship and seek guidance from individuals who have successfully overcome financial struggles. They reach out to mentors who can provide advice, share insights, and offer support. By learning from those who have walked a similar path, they gain valuable knowledge and perspective that can help them make informed decisions.

Broke people also recognize the importance of giving back to their community. Despite their financial constraints, they find ways to volunteer or contribute their time and skills to organizations in need. By helping others, they create meaningful connections and strengthen their support network.

Broke people build a support network by leveraging community resources, engaging in networking, seeking mentorship, and giving back to their community. They understand that they don’t have to face their financial struggles alone and that there are resources and people available to support them along the way.

Related: Breaking the Cycle: 5 Bad Spending Habits to Ditch Today

Pursuing passions: How broke people make room for hobbies and interests

Broke people understand the importance of pursuing their passions and find ways to make room for hobbies and interests, even when finances are tight. They recognize that hobbies and interests provide joy, fulfillment, and a sense of purpose, and prioritize them in their lives.

One way broke people pursue their passions is by exploring low-cost or free hobbies. They engage in activities that require minimal financial investment, such as reading, writing, drawing, or cooking. By finding joy in simple yet meaningful hobbies, they enhance their well-being without straining their budget.

Broke people also tap into their creativity and resourcefulness to find affordable ways to pursue their passions. For example, if their passion is photography, they may borrow equipment from friends or utilize their smartphones to capture stunning images. If their passion is music, they may join community bands or explore free online tutorials to learn new skills. By thinking outside the box, they find ways to indulge in their passions without overspending.

Additionally, broke people seek out opportunities to turn their hobbies into potential income streams. They explore freelance or gig work related to their interests, such as writing, graphic design, or tutoring. By monetizing their passions, they not only create additional income but enjoying what they do as well.

The mindset shift that allows broke people to find money for what truly matters

Struggling with finances is a common predicament for many, but somehow, broke people always manage to find a way to afford certain things that others might find extravagant. In this article, we will delve into the mysterious world of broke people’s spending habits and reveal how they always seem to scrape together enough money for these ten things.

From the latest tech gadgets to luxury vacations, we will uncover their secrets and shed light on their ingenious money-saving strategies.

Whether it’s the art of couponing, mastering the art of DIY, or simply knowing where to look for the best deals, broke people have developed unique approaches to stretch their budgets and fulfill their dreams. By understanding their tactics, we can all learn a thing or two about making the most of our own financial situation.

Join us as we unveil the hidden paths broke people take to afford these indulgences. Get ready to unlock the secrets behind their wizardry and gain insights that can transform the way you approach your own personal finances.

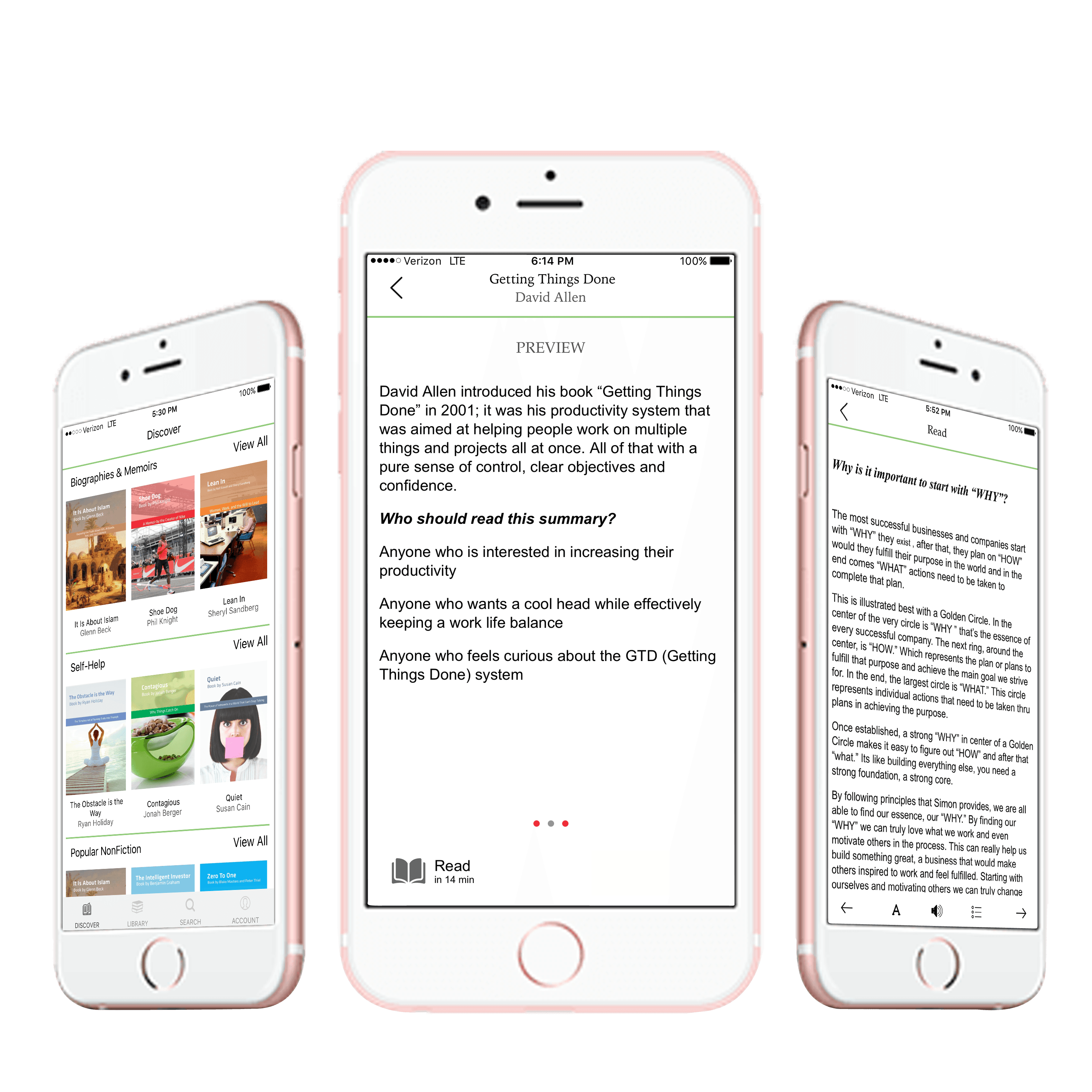

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.