Are you tired of living paycheck to paycheck? Do you find yourself constantly struggling to pay off debt or save for the future? It’s time to break the cycle of bad spending habits that are holding you back.

In this article, we will outline five common financial mistakes that many individuals make and provide practical solutions to overcome them. With the right knowledge and a little bit of discipline, you can regain control of your finances and set yourself up for a brighter future. From impulse buying to failing to budget, these bad habits can have a significant impact on your financial health.

By identifying and ditching these habits, you’ll be one step closer to achieving your financial goals. So, if you’re ready to take charge of your money and stop the endless cycle of poor spending choices, keep reading. It’s time to break free and start building the life you deserve.

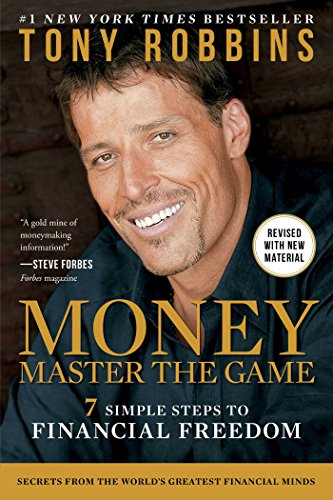

Money Master the Game

by Anthony Robbins

⏱ 15 minutes reading time

🎧 Audio version available

The impact of bad spending habits

Poor spending habits can have a profound impact on your financial well-being. They can keep you trapped in a cycle of debt, prevent you from saving for the future, and hinder your ability to achieve financial stability. The first step towards breaking free from these habits is to recognize their detrimental effects.

One major consequence of bad spending habits is the accumulation of debt. Whether it’s credit card debt, personal loans, or student loans, being burdened with debt can be overwhelming. High-interest rates and minimum payments can make it difficult to escape this cycle. Additionally, excessive spending can lead to a lack of emergency funds, leaving you vulnerable to unexpected expenses.

Furthermore, bad spending habits can hinder your ability to save for important goals such as buying a house, starting a family, or retirement. Without proper financial planning and discipline, you may find yourself constantly struggling to make ends meet and falling short of your aspirations. It’s essential to identify these habits and take action to break free from their grasp.

Bad habit #1: Impulse buying

One of the most common bad spending habits is impulse buying. It’s that sudden urge to purchase something on a whim, without giving it much thought. Whether it’s a trendy gadget, a new pair of shoes, or a fancy dinner, impulse buying can wreak havoc on your finances.

Impulse buying can be fueled by various factors, such as emotional triggers, peer pressure, or the desire for instant gratification. It’s important to remember that these impulsive purchases often provide only temporary satisfaction, leaving you with buyer’s remorse and a dent in your bank account.

To overcome this habit, it’s crucial to practice self-control and adopt a more mindful approach to spending. Before making a purchase, ask yourself if it aligns with your long-term goals and if it’s something you truly need. Implement a waiting period, such as a 24-hour rule, where you give yourself time to think about the purchase before making a final decision. By doing so, you’ll be able to distinguish between impulsive wants and genuine needs, ultimately saving yourself from unnecessary expenses.

Bad habit #2: Using credit cards irresponsibly

Credit cards can be powerful financial tools when used responsibly. However, when used carelessly, they can quickly become a pathway to financial disaster. Many individuals fall into the trap of excessive credit card debt, thanks to bad spending habits.

Using credit cards irresponsibly often involves maxing out credit limits, making only minimum payments, and carrying balances from month to month. This behavior can result in high-interest charges, penalty fees, and a never-ending cycle of debt.

To break free from this habit, it’s crucial to develop a responsible approach towards credit card usage. Start by creating a budget and sticking to it. Only charge expenses that you can afford to pay off in full each month. If you already have credit card debt, prioritize paying it off as soon as possible. Consider strategies such as the debt snowball or debt avalanche method to accelerate your progress. By using credit cards responsibly, you can build a positive credit history and avoid the pitfalls of excessive debt.

Bad habit #3: Neglecting to budget

Neglecting to budget is a common mistake that many people make. Without a clear understanding of your income and expenses, it’s easy to overspend and lose track of your financial goals. Budgeting is the foundation of financial success and an essential tool for managing your money effectively.

Creating a budget allows you to allocate your income towards your priorities, such as savings, debt repayment, and necessary expenses. It helps you identify unnecessary expenses and make informed decisions about where your money should go. By neglecting to budget, you risk overspending, living beyond your means, and failing to save for the future.

To overcome this habit, start by tracking your expenses for a month to get a clear picture of where your money is going. Then, create a realistic budget that aligns with your financial goals and priorities. Utilize budgeting apps or spreadsheets to make the process easier and more efficient. Regularly review and adjust your budget as needed. By taking control of your finances through budgeting, you’ll be able to make informed decisions and achieve financial stability.

Bad habit #4: Overspending on non-essentials

Another bad spending habit that can drain your finances is overspending on non-essential items. It’s easy to get caught up in the allure of consumer culture and feel the pressure to keep up with the latest trends.

However, constantly splurging on unnecessary purchases can hinder your financial progress and prevent you from reaching your goals.

To break free from this habit, it’s important to differentiate between needs and wants. Focus on purchasing items that provide long-term value and align with your priorities. Before making a non-essential purchase, consider the opportunity cost – what you could use that money for instead. Implementing a “one in, one out” rule can also help prevent clutter and unnecessary spending. For every new item you bring into your life, remove an old one.

Additionally, practice delayed gratification by saving up for big-ticket items instead of relying on credit. By being more intentional with your spending and prioritizing your financial goals, you can avoid the trap of overspending on non-essentials.

Bad habit #5: Ignoring savings goals

Many individuals neglect to prioritize savings, leading to a lack of financial security and an inability to reach important milestones. Ignoring savings goals can leave you unprepared for emergencies and prevent you from achieving long-term financial stability.

To overcome this habit, it’s crucial to make saving a priority. Start by setting specific savings goals, such as an emergency fund, a down payment for a house, or retirement savings. Automate your savings by setting up recurring transfers from your checking account to a separate savings account. Treat your savings as a non-negotiable expense, just like any other bill.

Additionally, consider ways to boost your savings, such as reducing discretionary expenses, negotiating bills, and finding ways to increase your income. By actively working towards your savings goals, you’ll be better equipped to handle unexpected expenses and build a solid financial foundation.

Breaking the cycle: Tips for overcoming bad spending habits

Now that we have identified five common bad spending habits, let’s explore some practical tips for breaking free from these destructive behaviors.

- Educate yourself: Take the time to learn about personal finance and money management. Read books, listen to podcasts, or attend workshops to gain a better understanding of how money works and how you can make it work for you.

- Set realistic goals: Develop clear and achievable financial goals that motivate you. Whether it’s becoming debt-free, saving for a dream vacation, or retiring early, having specific goals will keep you focused and motivated to overcome bad spending habits.

- Track your expenses: Keep a detailed record of your spending to identify patterns and areas where you can cut back. Utilize budgeting apps or spreadsheets to make tracking easier and more efficient.

- Practice mindful spending: Before making a purchase, ask yourself if it aligns with your values and priorities. Take the time to consider the long-term impact of your spending decisions.

- Find support: Surround yourself with like-minded individuals who share your financial goals. Seek out accountability partners or join online communities focused on personal finance. Having support can make the journey towards breaking bad spending habits more enjoyable and sustainable.

Related: Building Wealth the Right Way: Why Get Rich Quick Schemes Won’t Work

Resources for financial education and support

If you’re looking for additional resources to further educate yourself and find support on your journey towards financial freedom, here are a few recommendations:

- Personal finance books: “The Total Money Makeover” by Dave Ramsey, “Your Money or Your Life” by Vicki Robin and Joe Dominguez, and “Rich Dad Poor Dad” by Robert Kiyosaki.

- Podcasts: “The Dave Ramsey Show,” “The Money Guy Show,” and “ChooseFI.”

- Online communities: Reddit’s r/personalfinance and r/financialindependence, as well as various Facebook groups focused on personal finance.

- Financial advisors: Consider seeking professional advice from a certified financial planner to help you create a personalized financial plan.

Remember, breaking bad spending habits is a journey that requires commitment and discipline. Take it one step at a time, celebrate small victories, and stay focused on your long-term financial goals. With persistence and the right mindset, you can break free from the cycle of bad spending habits and create a brighter future for yourself.

Conclusion

Breaking free from bad spending habits is essential for achieving financial stability and reaching your long-term goals. By identifying and ditching common mistakes such as impulse buying, irresponsible credit card usage, neglecting to budget, overspending on non-essentials, and ignoring savings goals, you can take control of your finances and set yourself up for a brighter future.

Remember to educate yourself, set realistic goals, track your expenses, practice mindful spending, and seek support from like-minded individuals. Take the first step today and start building the life you deserve – a life free from the endless cycle of poor spending choices.

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.