You can see it already– the life you have planned. You don’t have to worry about debts anymore, the car you always wanted is in your garage, the house you planned out on Pinterest is a reality, and the most important dream of all has been reached: you have financial freedom.

But on our quest to gain that precious, debt-free, stress-free life, there are a lot of easy mistakes you can make. Don’t let these common errors of business ownership be your downfall. With the right knowledge, the right planning, and of course, your passion for entrepreneurship, you can have a profitable, successful operation very quickly.

Welcome to Snapreads! Today, we’re counting down the 7 most common mistakes entrepreneurs make when planning for financial freedom. Let’s get started!

Money Master The Game

by Tony Robbins

⏱ 16 minutes reading time

🎧 Audio version available

They Keep the Same Spending Habits

This is probably the most common mistake. On their quest to liberating financial freedom, many fall back into the same old spending habits or only make such minuscule changes that it doesn’t matter. As you can expect, no one can do the same thing repeatedly and expect different results. That is literally Albert Einstein’s definition of insanity.

If you want to get out of debt, to not have to worry about your next paycheck, and not stress about what would happen if you lost your business, it’s time to make drastic changes. You need to determine what you should reasonably spend within a given month and save the rest. The key is changing your spending habits so that you stay within your means. Remember, you’re on the road to achieving the life you want.

So, a realistic budget is an ideal move. It will help you avoid spending money unnecessarily.

Ignoring Their Retirement and Emergency Funds

Of course, we get it. On the way to achieving financial freedom, it may make sense to direct your efforts into paying off your debts, but ignoring your retirement and emergency funds? That’s a major misstep, and unfortunately, a common one.

Think about it like this: isn’t your retirement account meant to contribute to your financial stability once you retire? The “long run” may seem too far away to consider, but the sooner you start preparing for it, the better off you’ll be.

Just because you have current debt doesn’t mean you should stop planning for the future, no matter how distant it seems. The same goes for emergency money. Having a sufficient amount of money on hand for emergencies is a life-changer, no matter what your financial situation looks like.

One unexpected injury, accident, or even a car repair can dramatically affect your budget.

You can avoid this common mistake by doing what the pros do: putting aside three to six months of expenses into a valuable savings account that will sit untouched until there’s an emergency.

If you’re not convinced, remember that you can fall into further debt if this unexpected expense proves too costly. You may think this is going to hold you back from achieving freedom, but this will change your life.

Try to Pay Off Multiple Debts At Once

Chances are you have several debts holding you back. Now, if you have multiple sources of debts, it may be tempting to try paying all of them off at the same time, but this is a major mistake. Not all debts are created equal, so trying to pay off large portions of each one every month isn’t progress. Of course, you’ll still need to pay the minimum payment on each bill or loan, but we’re targeting the mistake of putting in extra money.

Now, how can you avoid this fatal mistake? Start with the debt that has the highest interest rate. And focus on it instead of paying off all your debts evenly. After that debt is safely paid off, go through the rest of the debts, working your way through the ones with the highest interest rates. Keep working at it until you are left with more manageable expenses. And there you have it, you have gotten rid of the highest interest rates.

Not Separating Personal and Business Accounts

The next mistake is not separating personal and business accounts. Oftentimes, entrepreneurs start out thinking that because they may not be making a profit yet, they don’t need a separate business account.

Or they may think that, since they are technically just freelancers and haven’t incorporated, they don’t need a business account.

But from the moment you start earning money for your services, you are officially a small business owner. That means whether you’re an entrepreneur, a solopreneur, a consultant, or a freelancer, or whatever title you use, you need a separate bank account.

Depending on your bank, you may not even need to set up a business account. In the beginning, you can have a checking account that you only use for transactions that involve your business. This way, you can easily keep track of every payment coming in and every penny going out that is related to your business. By the time you finally incorporate, you can proudly say that you have a clear ledger without any personal expenses in the way.

Take the words of Graeme Donnely, the CEO of Quality Formations. He says,

“It’s also important for entrepreneurs to separate their personal finances from their business. Entrepreneurs should treat a business as a separate entity. This is one of the biggest challenges for a sole- proprietorship. We encourage our clients to incorporate early, the costs are not as high as they seem. Besides, the benefits far outweigh the costs.”

Not Planning for Tax Liability

The third most common mistake entrepreneurs make is not taking tax liability into account. If you had been working a regular, full time job, then you are already familiar with seeing taxes deducted from your paycheck. However, once you embark on your own path and you begin earning money, you are now solely responsible for your tax liability.

This is a trap many entrepreneurs fall into. In the beginning, it may be simple, but as your business grows, you may find yourself getting too caught up in the hustle and bustle of day to day stuff, and your tax responsibilities will take a backseat.

To avoid this, it’s best– and again, this depends on your country and city– to pay quarterly taxes on your income to stay ahead and on top of your tax liability.

Liquidity

An issue that most people don’t bother to take into account– the liquidity of your portfolio. Most people focus more on returns, but what they need to keep in mind is that a portfolio needs to be balanced. If you want to achieve a balanced portfolio, there is another criteria to be mindful of, which is liquidity. Some believe even say that the liquidity of your portfolio is one of the most important data points that you must keep a careful eye on.

So, make sure you understand the current liquidity of your portfolio, and how you can improve or reduce it depending on your needs.

Not Having a Clear Budget

There is an alarming number of entrepreneurs who haven’t learned the correct way to budget their business. This is one of the most important skills you can have. Want a sure way to avoid stress? Knowing how much and where money is going to be spent on a monthly basis can be an incredible help.

Budgeting involves discipline, which may be the most difficult part, because you’re already juggling a million different things. However, it’s time to cut out things that don’t fit your budget and focus on what holds the most importance.

Most entrepreneurs forget that it’s far easier to lose money than it is to earn it. And often, while a single financial decision can cause the downfall of a business, chances are that it’s a series of bad decisions and financial mistakes that will affect you the most. And now, you can avoid these mistakes!

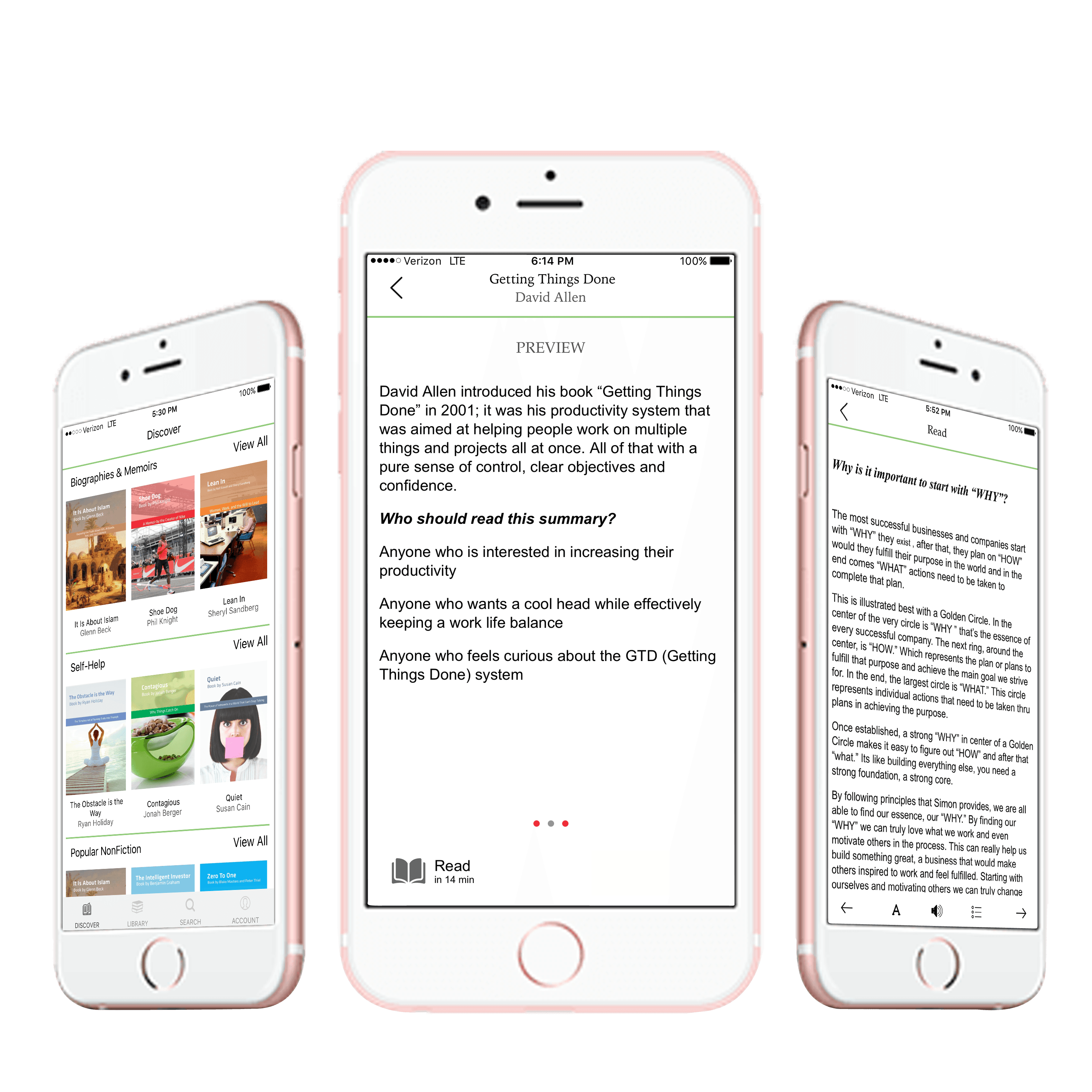

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.