Are you tired of hearing about get-rich-quick schemes that promise instant wealth with minimal effort? Well, you’re not alone. In today’s fast-paced and highly competitive world, many individuals are searching for the secret formula to building wealth rapidly.

However, the truth is that there are no shortcuts to financial success. Building wealth the right way requires patience, discipline, and a solid strategy.

In this article, we will explore why get-rich-quick schemes won’t work and why it’s essential to adopt a long-term approach to wealth creation. From debunking common myths to providing practical tips and advice, we will equip you with the knowledge and tools necessary to embark on a sustainable path towards financial prosperity.

So, if you’re ready to ditch the empty promises and discover the real secrets to building wealth, keep on reading!

Money Master the Game

by Anthony Robbins

⏱ 15 minutes reading time

🎧 Audio version available

Understanding the Dangers of Get Rich Quick Schemes

Get-rich-quick schemes have been around for centuries, promising individuals the opportunity to make a fortune overnight. These schemes often prey on people’s desire for instant gratification and the allure of easy money. However, the reality is that most get-rich-quick schemes are nothing more than scams designed to separate you from your hard-earned money.

One of the biggest dangers of get-rich-quick schemes is the false hope they provide. They paint a picture of a luxurious lifestyle and financial freedom, creating unrealistic expectations in the minds of those who fall for their promises. These schemes often require individuals to invest significant sums of money upfront, with the assurance of high returns in a short period. But more often than not, these investments turn out to be nothing but a waste of time and money.

Furthermore, get-rich-quick schemes often rely on recruitment and pyramid-like structures. They promise individuals lucrative commissions and bonuses for recruiting others to join the scheme. This not only perpetuates a cycle of exploitation but also puts individuals at risk of legal trouble. Many countries have strict laws against pyramid schemes and multi-level marketing schemes that operate on a similar principle.

Get-rich-quick schemes are dangerous for several reasons. They provide false hope, require significant upfront investments, and often operate in a pyramid-like structure. To build wealth the right way, it’s crucial to understand that there are no shortcuts and to be wary of any scheme that promises otherwise.

The Importance of Building Wealth the Right Way

Now that we’ve established the dangers of get-rich-quick schemes, let’s delve into why it’s important to build wealth the right way. The key lies in sustainability and long-term financial security. While get-rich-quick schemes may offer temporary gains, they rarely provide a solid foundation for lasting wealth.

Building wealth the right way involves adopting a mindset shift. It requires patience, discipline, and a long-term plan. Instead of seeking instant gratification, individuals should focus on developing good financial habits and making smart choices that will yield sustainable results.

Another crucial aspect of building wealth the right way is understanding the value of delayed gratification. It’s about being willing to sacrifice short-term pleasures for long-term gains. This mindset shift allows individuals to make informed decisions and prioritize their financial well-being over impulsive spending.

Moreover, building wealth the right way ensures financial independence and freedom. By taking control of your finances and making wise choices, you can create a future where you are no longer dependent on a paycheck or living paycheck to paycheck. This sense of security and peace of mind is invaluable and cannot be achieved through get-rich-quick schemes.

Building wealth the right way is essential for long-term financial security and independence. It requires a mindset shift, patience, and discipline. By prioritizing sustainability over instant gratification, individuals can lay the foundation for lasting wealth.

The Mindset Shift: Patience and Long-Term Planning

Now that we understand the importance of building wealth the right way, let’s dive deeper into the mindset shift required to achieve this goal. Patience and long-term planning are key factors in building wealth sustainably.

First and foremost, it’s crucial to acknowledge that building wealth takes time. Rome wasn’t built in a day, and the same applies to financial success. Get-rich-quick schemes often prey on the desire for instant results, but true wealth is accumulated gradually over the years.

To develop patience, it’s essential to set realistic goals and break them down into manageable steps. This approach allows you to celebrate small victories along the way and stay motivated. Remember that wealth accumulation is a marathon, not a sprint.

Alongside patience, long-term planning is vital. This involves creating a financial roadmap that aligns with your goals and values. Start by assessing your current financial situation, including your income, expenses, and debts. Then, develop a budget that allows you to save and invest regularly. Set aside emergency funds to prepare for unexpected expenses and establish a retirement plan for your future.

Furthermore, seek professional advice from financial advisors or experts who can help you make informed decisions. They can provide guidance on investment strategies, tax planning, and risk management. Remember that building wealth is not a solo journey, and seeking support from professionals can significantly enhance your chances of success.

The mindset shift towards patience and long-term planning is crucial for building wealth sustainably. By setting realistic goals, breaking them down into manageable steps, and seeking professional advice, individuals can lay the foundation for financial prosperity.

Developing a Solid Financial Foundation

In the pursuit of building wealth the right way, developing a solid financial foundation is paramount. This foundation serves as the building blocks for future wealth accumulation and provides stability during uncertain times.

Here are some key steps to establish a solid financial foundation:

- Create a budget: Start by tracking your income and expenses to gain a clear understanding of your financial situation. Allocate funds for essential needs, savings, debt repayment, and discretionary spending. Stick to your budget and make adjustments as necessary.

- Pay off high-interest debts: High-interest debts such as credit card balances can hinder wealth accumulation. Prioritize paying off these debts to free up your cash flow and reduce interest payments. Consider debt consolidation options to streamline your repayments.

- Build an emergency fund: Life is unpredictable, and unexpected expenses can derail your financial progress. Establish an emergency fund that can cover at least three to six months’ worth of living expenses. This fund acts as a safety net during challenging times and prevents you from falling into debt.

- Protect yourself with insurance: Adequate insurance coverage is essential to protect your financial well-being. Evaluate your insurance needs, including health insurance, life insurance, and property insurance. Consult with insurance professionals to ensure you have the right coverage for your circumstances.

- Invest in your education and skills: Building wealth is not just about money; it’s also about personal growth and development. Invest in improving your knowledge and skills to enhance your earning potential. This can include pursuing higher education, attending workshops, or acquiring certifications in your field.

By focusing on these steps, you can lay a solid financial foundation that will support your wealth-building journey. Remember that building wealth is a continuous process, and it’s essential to regularly review and adjust your financial plan as your circumstances change.

Investing Wisely for Long-Term Wealth Accumulation

Building wealth the right way involves investing wisely for long-term wealth accumulation. While saving money is crucial, investing allows your money to grow and work for you. Here are some key principles to consider when investing for wealth accumulation:

- Diversify your investments: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds. This diversification helps reduce risk and maximize potential returns.

- Understand your risk tolerance: Investing involves risks, and it’s important to understand your risk tolerance. Assess your financial goals, time horizon, and comfort level with market fluctuations. This will help you determine the appropriate investment strategy for your circumstances.

- Invest for the long term: Building wealth is a marathon, and investing should be approached with a long-term mindset. Avoid trying to time the market or chase short-term gains. Instead, focus on quality investments that have the potential to grow steadily over time.

- Stay informed: Stay updated on market trends, economic indicators, and investment opportunities. Read financial publications, follow reputable sources, and consider seeking professional advice. Knowledge is power when it comes to making informed investment decisions.

- Review and rebalance your portfolio: Regularly review your investment portfolio and rebalance it as necessary. Market conditions and your financial goals may change over time, requiring adjustments to your asset allocation. Consult with financial advisors to ensure your portfolio remains aligned with your objectives.

Remember that investing involves risks, and there are no guarantees of returns. However, by following these principles and making informed decisions, you can increase your chances of long-term wealth accumulation.

Building Multiple Streams of Income

In the quest for building wealth the right way, diversifying your income sources is crucial. Relying solely on a single source of income leaves you vulnerable to financial instability. Here are some strategies to build multiple streams of income:

- Start a side business: Consider starting a side business that aligns with your skills and interests. This can be anything from freelancing, consulting, or selling products online. A side business not only generates additional income but also provides a safety net if your main source of income is disrupted.

- Invest in income-generating assets: Real estate, stocks, bonds, and dividend-paying investments can generate passive income. Explore investment opportunities that provide regular cash flow and potential appreciation over time. Conduct thorough research and seek professional advice before making any investment decisions.

- Develop passive income streams: Passive income streams require upfront effort but can generate income on an ongoing basis. This can include royalties from intellectual property, rental income from properties, or income from online courses or e-books. Look for opportunities to leverage your skills or assets to create passive income.

- Explore alternative investment options: Beyond traditional investments, explore alternative investment options such as peer-to-peer lending, crowdfunding, or investing in startups. These options offer unique opportunities for diversification and potentially higher returns.

Building multiple streams of income provides financial security and flexibility. It reduces reliance on a single source of income and increases your ability to weather financial challenges.

The Power of Compound Interest and Time

When it comes to building wealth, the power of compound interest and time cannot be overstated. Albert Einstein is famously quoted as saying, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pays it.” Let’s explore why compound interest and time are critical factors in wealth accumulation.

Compound interest is the concept of earning interest on both the principal amount and any accumulated interest. This compounding effect allows your investments to grow exponentially over time. The longer your money remains invested, the greater the compounding effect becomes.

For example, let’s say you invest $10,000 with an annual interest rate of 5%. After one year, you would earn $500 in interest. However, if you leave that money invested for 20 years, the compounding effect would result in a total of $26,533. By simply allowing your money to grow through compound interest, you can significantly increase your wealth.

Time is a crucial element in leveraging the power of compound interest. Starting early and allowing your investments to compound over a long period can have a profound impact on your financial future. Even small contributions made consistently over time can grow into substantial sums due to the compounding effect.

Therefore, it’s important to start investing as early as possible and stay invested for the long term. This allows you to take full advantage of the power of compound interest. Delaying your investments can significantly limit the potential for wealth accumulation.

Real-Life Success Stories of Individuals Who Built Wealth the Right Way

To provide further inspiration and motivation, let’s explore real-life success stories of individuals who built wealth the right way. These individuals exemplify the principles we’ve discussed and serve as proof that sustainable wealth is achievable through hard work, discipline, and a long-term mindset.

- Warren Buffett: Often hailed as one of the greatest investors of all time, Warren Buffett built his wealth through sound investment principles and a long-term perspective. He started investing at a young age and focused on value investing, buying quality companies at reasonable prices. Over the years, his wealth has grown exponentially through the power of compounding.

- Oprah Winfrey: From humble beginnings, Oprah Winfrey built her wealth through hard work, determination, and a commitment to excellence. She leveraged her talent as a talk show host and media personality to create a media empire. By focusing on her strengths and continually reinvesting in herself, Oprah has become one of the most successful and influential women in the world.

- Elon Musk: Known for his revolutionary companies such as Tesla and SpaceX, Elon Musk is a prime example of someone who built wealth through innovation and perseverance. He took risks, faced setbacks, and continued to pursue his vision despite challenges. His dedication to creating sustainable solutions and pushing boundaries has led to immense financial success.

These success stories highlight the importance of hard work, discipline, and a long-term mindset in building wealth the right way. They serve as reminders that there are no shortcuts to success and that sustainable wealth is achievable for those who are willing to put in the effort.

Related: The One Essential Key to Wealth Building No One Talks About

Conclusion: Choosing Sustainable Wealth Over Quick Fixes

In conclusion, building wealth the right way requires a shift in mindset, patience, and a long-term approach. Get-rich-quick schemes may offer temporary gains, but they rarely provide a solid foundation for lasting wealth. By understanding the dangers of such schemes and adopting a sustainable approach, individuals can embark on a path towards financial prosperity.

Developing a solid financial foundation, investing wisely, building multiple streams of income, and leveraging the power of compound interest and time are key strategies for building wealth sustainably. Real-life success stories serve as inspiration and proof that the principles discussed in this article can lead to significant financial success.

So, instead of falling for empty promises and quick fixes, choose to build wealth the right way. Embrace the journey, be patient, and stay committed to your financial goals. With the right mindset and strategies, you can achieve long-term financial security and enjoy the rewards of sustainable wealth.

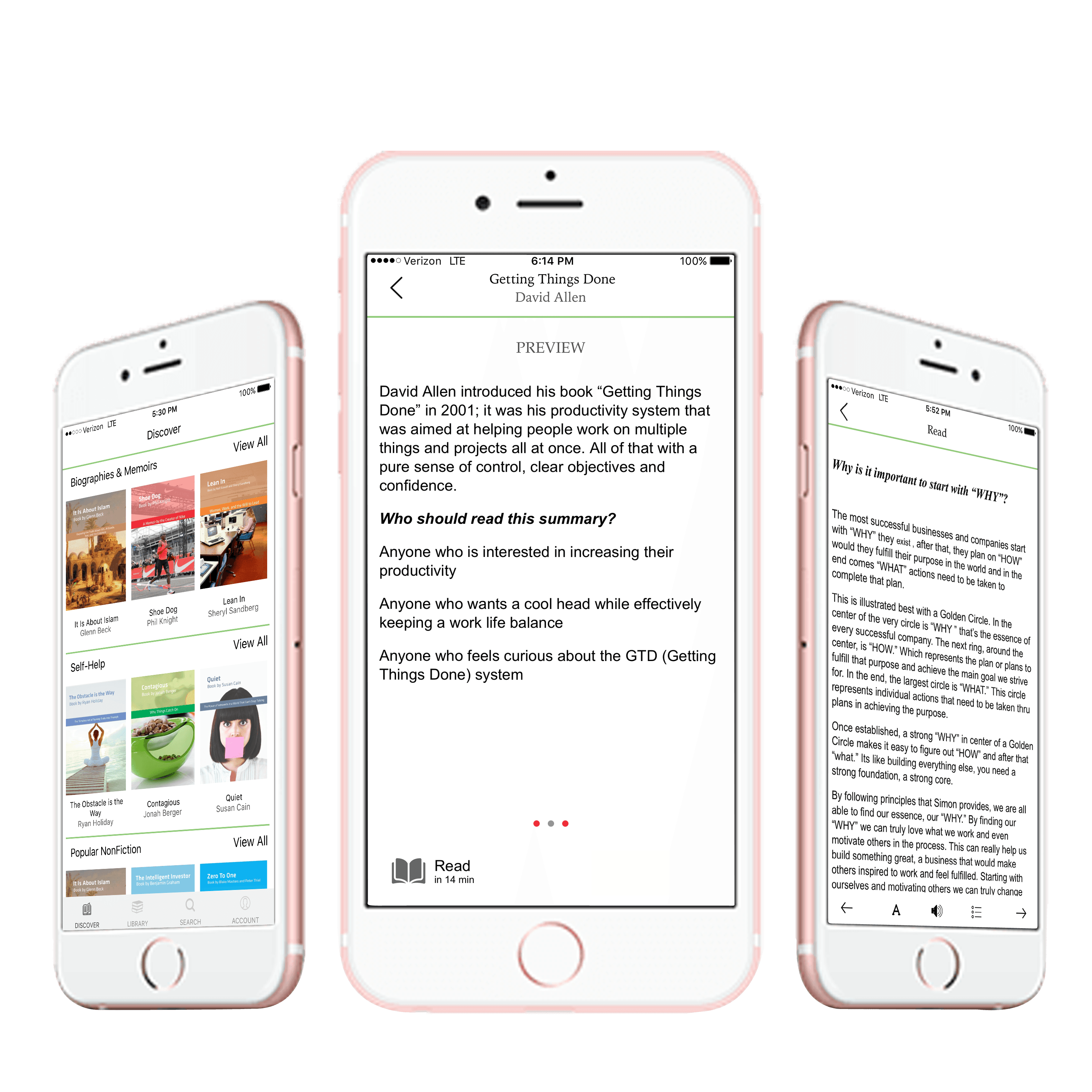

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.