If attaining financial freedom and ensuring that you have enough money to provide an ideal lifestyle for you and your family is your goal, it is essential to begin focusing on building wealth as soon as possible.

With the right approach, it is entirely feasible to turn a meager amount of money into a small fortune over time. With that in mind, here are three valuable pieces of advice for building wealth that you may not have heard before.

Focus on Paying off Debt First

Nothing eats into your income and prevents you from building wealth quite like high-interest debt. While avoiding debt at all costs is certainly the best approach, it isn’t always possible. If you still owe money on your home, credit cards, car, or student loans, paying this debt off should be your first and most important financial priority.

Since debt compounds over time – especially high-interest debt – the amount that you owe will grow exponentially larger over time if left unpaid. Before you begin investing in the stock market or putting your money to use in some other way, make sure that you take care of any debt that is holding you back.

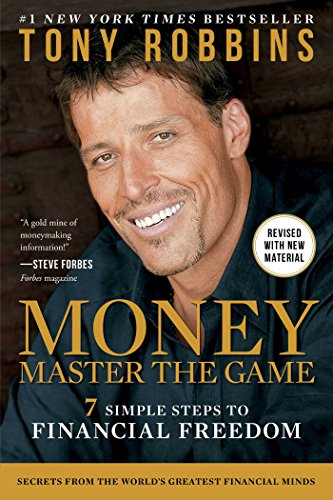

Money Master the Game

By Tony Robbins

⏱ 14 minute reading time

🎧 Audio version available

The Stock Market is Your Friend

There’s no better way to build wealth than investing in the stock market. While the market does come with a certain degree of risk that scares away many would-be investors, the rewards far outweigh the risk –, especially over the long-run.

On average, the S&P 500 has grown around 10% per year since 1926. This means that just $10,000 invested across the stock market in 1960 would be worth a staggering $3,044,816 today.

As you can see, you don’t need a ton of money to achieve extraordinary returns in the market. What you do need, though, is plenty of patience and a strong stomach in order to keep your emotions from getting the better of you.

Emotions are the enemy of investing, and decisions made out of greed or fear will often backfire. With enough time and the right approach, though, the stock market has the potential to make almost anyone wealthy.

Related: 6 Proven Steps to Financial Freedom

Personal Decisions Matter Above all Else

More important than paying off debt and more important than investing in the stock market is the thousands of little decisions that you make along the way. As we’ve already discussed, the stock market makes it relatively simple to compound your money over time.

However, the choices you make regarding your career, lifestyle, and spending habits will ultimately determine how much money you have to invest, if any, at all.

Work hard in your chosen career, commit to saving as much money as possible, constantly be on the lookout for new opportunities, and carefully avoid costly financial mistakes.

If you are able to do all of these things as well as take advantage of the incredible opportunity that the stock market offers, you will become wealthy over time. It’s almost a guarantee.

Your Snapreads Free Trial

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.