Financial freedom is a goal that most seek to attain on a daily, monthly and yearly basis. It generally means having enough savings, investments, and cash on hand to afford the lifestyle you want for you and your family.

It’s the freedom to quit your job you don’t like to pursue a career that you love without being driven by earning a certain amount each year to cover your expenses.

Unfortunately, most fail to achieve financial freedom. We’re burdened with increasing debt, financial emergencies, unplanned spending, and other issues that keep us from reaching our goals.

It happens to everyone, but here are six proven steps to put you on the right path to financial freedom.

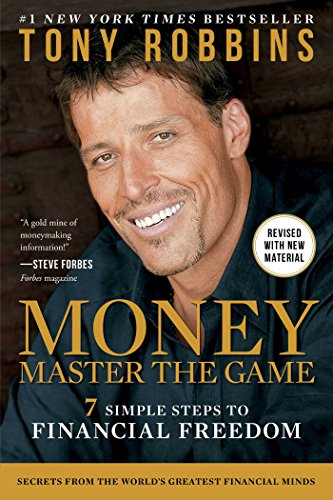

Money Master the Game

By Tony Robbins

⏱ 14 minute reading time

🎧 Audio version available

Define Financial Freedom For You

We all strive to acquire financial freedom, but do we know what that means? Financial freedom is taking responsibility for your finances. Strive to have a dependable amount of money set aside that you can live the life desired or deserved. Allow yourself to be worry-free of bills, unexpected expenses, or locked down to an excessive amount of debt.

Write Down Your Goals

Be specific; write down detailed goals. Make your goals specific to your lifestyle. Write down how much you have and how much you should have in your bank account, what lifestyle you are striving for and what age you plan on achieving this lifestyle.

Understand where you are now and where you plan to be in the future. The higher you set the goals, the more likely you are to achieve them.

Pay Yourself First

Make yourself a priority and pay yourself first. Most people do not have enough for retirement or emergency funds because they do not pay into those accounts or take advantage of their benefits.

Research what your job has to offer as far as benefits. Enroll in a retirement plan such as a 401K and take full advantage of the matching contribution benefits. Start small, but stay committed. Once you become more established, you can increase the amount paid to yourself.

Be Smart About Your Career Choice

It is important to plan out how much money you will need to support your lifestyle and vision of financial freedom. Ask yourself, are you able to support yourself with your current income?

If you answered no, take a look as to what you can do differently in your career. See if you are eligible for a raise or promotion. Ask your manager or supervisor if there are any opportunities to enhance your career with continuing education. Don’t be afraid to branch out and network as well.

Most jobs are not only earned through hard work and dedication but networking with others.

Trim your budget

Now start using your newly set goals and incorporate them into a monthly budget. This will allow you to be aware of your spending habits. Avoid spending more than you make, figure out what are needs versus wants.

Cut back on unnecessary expenses, cancel unused subscriptions, and avoid impulse buying. This will take some discipline, but the results will be significant.

Related: 3 Things You May Not Have Thought About Building Wealth

Create a Debt Payoff Plan

For some, debt is unavoidable, but do not be discouraged; there are strategies to tackle debt. Creating a debt payoff plan can relieve a lot of stress.

When budgeting takes into account debt payments, create a list of all your debts, take into account the minimum payment, interest rate, and total amount owed. Then start to rank them in the order you would like to pay them off.

Some suggest paying off debts with the highest interest first. But remember, focus on one debt at a time to prevent being overwhelmed. Place all extra money earned into paying off one debt at a time. It will be a sacrifice, but once all debt is paid off, you can focus on increasing your savings

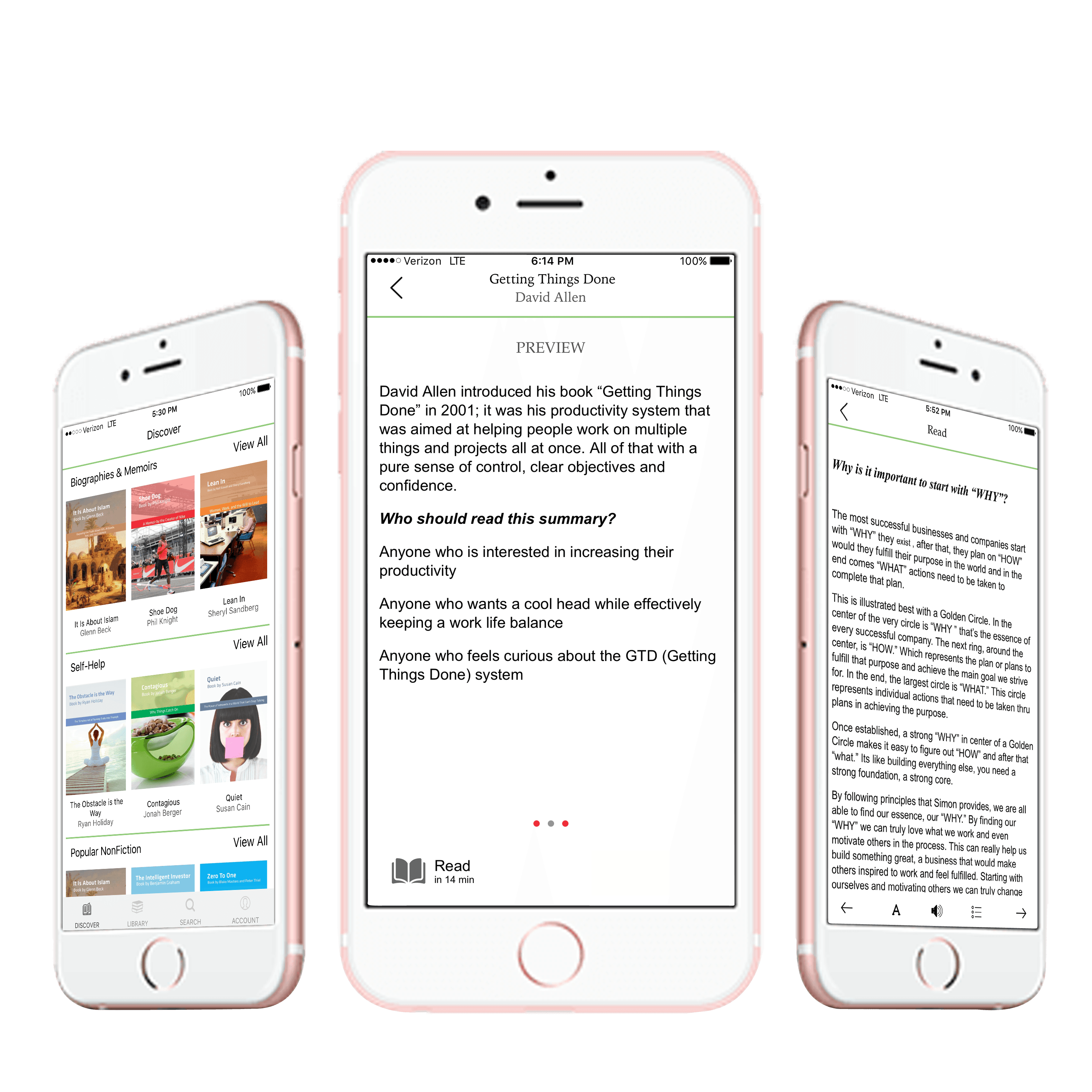

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.