Debt can be a crippling thing, shackling you to a burden that can make it nearly impossible to reach your financial goals. The good news is that there are proven methods for chipping away at debt a little at a time.

If you are looking for an effective way to start working toward a debt-free life, the debt snowball method may be the ideal debt-reduction strategy for you.

We’ll cover what the debt snowball method is, how it works, important pitfalls to avoid when making use of this method, and why the debt snowball method can be such an effective strategy for helping you eliminate your debts one at a time and finally achieve a debt-free life.

What is the Debt Snowball Method?

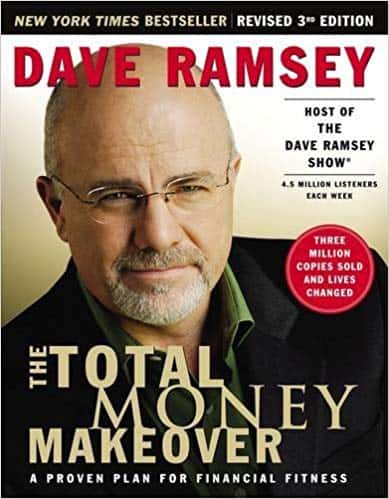

The debt snowball method is a debt-reduction strategy that is championed by author and financial expert Dave Ramsey. This method involves paying off your smallest balances first while paying only the minimum on your larger balances, working your way up the ladder until you are debt-free.

If you are interested in trying the debt snowball method out for yourself, here are the steps that you should follow: Create a list of your debts, then rank them in ascending order, starting with your smallest balance and ending with your largest. Commit to paying at least the minimum amount due on every debt you list.

Determine how much money beyond the minimum you can pay on your smallest debt balance. Pay as much as possible toward your smallest debt balance while paying the minimum on all other debt balances. Continue to do this until your lowest debt balance is completely paid off.

Move on to your next smallest debt balance and repeat the process. Continue working your way down your list of debts, paying them off one at a time in order from least to greatest until you are debt-free.

The Total Money Makeover

by Dave Ramsey

⏱ 12 minutes reading time

🎧 Audio version available

The Benefits of the Debt Snowball Method

One of the biggest benefits of paying off debt using the debt snowball method is that it is gratifying to pay off a balance that you owe altogether.

By focusing on your smallest balances first, you can feel the reward of closing out a debt early and often before you need to move on to pay off your larger debts. In many cases, this reward is more than enough to motivate a person to follow through with their goal of becoming debt-free.

If you are dealing with more debts than you know how to handle, making use of the debt snowball method can be a great way to organize your debts and begin the process of paying them off one by one.

Too much debt is a major shackle on anyone’s life. Thankfully, though, there are ways to find the light at the end of the tunnel and begin striving toward a debt-free future.

Related: The Only Two Finance Books You Need to Read

An Example of the Debt Snowball Method in Action

To help you better understand how the debt snowball method works and why it is so effective at freeing people from the shackle of excess debt, let’s take a look at a hypothetical example of the debt snowball method in action.

Consider George. George just graduated from college and already has several debts that he needs to pay off. Here are the obligations that George currently owes, along with the minimum payment that is owed on these debts each month:

$650 medical bill – $40 a month minimum payment $8,500 student loans – $100 a month minimum payment $11,000 car loan – $120 a month minimum payment $1,800 credit card debt – $50 a month minimum payment

Now, let’s say that George has $500 a month to pay off his debt, and let’s say that George has decided to use the debt snowball method to pay these debts off as efficiently as possible. In George’s case, here is what making use of the debt snowball method would look like:

George would first focus on paying off his medical bill since it is the lowest amount of his current debts. After paying the minimum monthly payment on all of his other debts, George will have $230 each month to pay his medical bill debt.

At this rate, it will take three months before his medical bill is entirely paid off, at which point George should shift his focus to paying off his credit card debt.

Now that the medical bill is out of the way, though, George will have $280 leftover each month to put toward his credit card debt after paying the minimum balance on all of his other obligations.

At this rate, it will take seven months before George’s credit card debt is paid off, at which point he can shift his focus to paying off his student loans.

As you can see, using the debt snowball method means that George has more money to put toward his other debts each time he gets one of the smaller debts paid off. This aspect of the debt snowball method is where the method gets its name and why it is such an effective way to pay off your debts.

One of the biggest benefits of paying off debt using the debt snowball method is the fact that it is gratifying to pay off a balance that you owe completely.

A Few Important Pitfalls to Avoid if You are Going to Make Use of the Debt Snowball Method

While the debt snowball method can be incredibly effective at helping you pay off debts in the most efficient way possible, there are a few essential factors to keep in mind and pitfalls to avoid if you plan to use this method.

To start, it is essential to ensure that you are paying at least the monthly minimum on all of your debts to ensure that you don’t incur any hefty fees for failing to pay the minimum amount owed each month.

The second important factor to keep in mind is that the process dictated by the debt snowball method may not always be the best way to go about paying off your debts, depending on the interest rates associated with each account.

For example, if you have a credit card debt of $1,500 and a medical bill of $700, the debt snowball method dictates that you should focus on paying off the medical bill first before moving on to paying off your credit card debt.

However, if your credit card debt has an interest rate of 20% while your medical bill only has an interest rate of 7%, you can see why it would save you money to focus on paying off the credit card debt first rather than focusing on the medical bill first like the debt snowball method says you should.

In instances where the interest rates on your various debts are comparable, the debt snowball method is undoubtedly an excellent method to make use of. In the cases where one debt has an excessively high-interest rate compared to the other debts that you owe, you are probably better off eliminating your high-interest debt first, even if it is not the smallest debt that you own.

If you have multiple debt accounts that you money on, getting out of debt is one of the most important financial goals you can set for yourself – and the debt snowball method is one of the best ways to go about reaching this all-important goal.

While not necessarily a one size fits all solution, the debt snowball method is a great option to consider if you are looking for a way to pay off the debts that you owe beneficially and efficiently.

By focusing on paying off your debts one account at a time, starting with the lowest amount that you owe, you can eliminate your debts one by one and leave yourself with more money to put toward your other debts each time a new debt is eliminated.

So long as you have taken into account important factors such as paying off high-interest debt first and ensuring that you pay the monthly minimum on all of the debts that you owe to avoid being hit with fees, the debt snowball method is undoubtedly capable of helping you reach a debt-free life and all of the benefits that it has to offer.

Start Your Snapreads Free Trial

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.