We always strive to eat healthily, exercise and read more but improving your financial situation is one of the most popular goals to obtain.

But between paying rent, car payments, student loans, and juggling everyday expenses, most of us haven’t taken the time to think about establishing an emergency fund, planning for retirement, or investing. So what can you do to get a grip on your finances and make your money grow? Learn. Educate yourself.

While there are various books out there on how to budget, save, and invest money, it’s not easy to know which source of information is the most reliable and resourceful according to your financial situation. These two classics are essential keys to become financially successful no matter what stage you are in life.

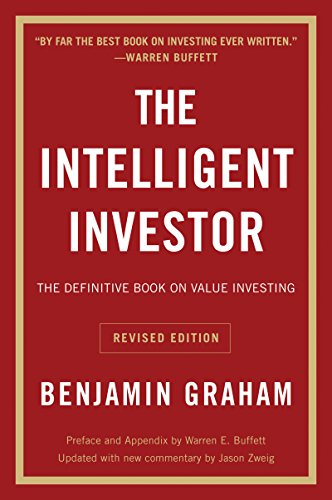

The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham

The Intelligent Investor

by Benjamin Graham

⏱ 16 minute reading time

🎧 Audio version available

Always analyze the long-term evolution and management principles of a company before investing.

When you’re buying shares — base decisions on the value of the underlying business. Graham’s approach is built on analyzing companies and not analyzing securities or trying to time the market. When you decide to invest, you should be investing in an asset with the intent of never taking the money out and watching it grow over the long term.

Protect yourself by diversifying investments.

Depending on your age and risk tolerance, diversify your portfolio of a combination of low-cost stock and bond index funds. The key is to not put more than 75% of your investments in one or the other. Diversify your assets and protect yourself. That’s precisely what intelligent investing is. Nobody can predict the next Facebook, but everyone can protect themselves against financial losses.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.”

The Intelligent Investor by Benjamin Graham

Stick to a strict formula and don’t get greedy

As an investor, your worst enemy is likely to be yourself. When markets start to fluctuate, emotions begin to escalate. Remove your emotions from investing by sticking to a strict formula. Graham refers to this as “formula investing”, but is also well known as dollar-cost averaging. What Graham is trying to say is simply set a fixed budget you’re going to invest each and every month – no matter the price. Employee contributions to 401(k) plans or IRAs are a great way to accomplish this.

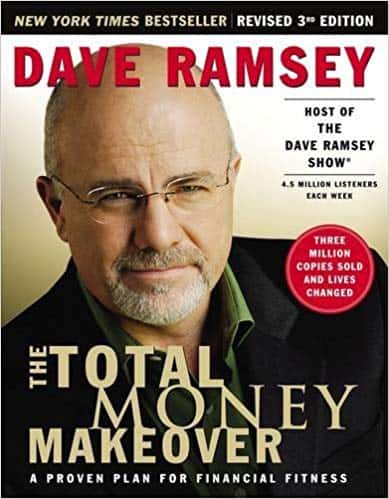

The Total Money Makeover: A Proven Plan for Financial Fitness by Dave Ramsey

The Total Money Makeover

by Dave Ramsey

⏱ 13 minute reading time

🎧 Audio version available

Baby step 1 – Build a $1,000 small emergency fund.

First things first, an emergency fund is always needed. There are always things that come up, and you want to be prepared. This will give you a small nest egg before tackling your debt.

Baby step 2 – Pay off all debt (except mortgage) using the “debt snowball”.

This is where most people are in the process. Did you know the average American has about $38,000 in personal debt, excluding home mortgages? (Source: CNBC). Using the debt snowball method, you can gain momentum by paying off your debt, starting with the smallest amount, and knocking them out one at a time.

Baby step 3 – Build a full-size emergency fund worth 3-6 months of expenses.

This will strongly depend on the type of income you have. If you have irregular income, you may want to save more. A 3-6 month emergency fund would give you a nest egg if anything were to come up. This is an excellent resource instead of digging into your 401k, getting a loan, or taking equity out of your house.

Related: How to Use the Debt Snowball Method to Pay Off Debt

Baby step 4 – Invest 15 percent of household income into Roth IRAs and pre-tax retirement plans.

This is the start of your “building wealth” stage. Once you pay off your everyday expenses, this is when you have the additional money you can stash away for your future self. No matter your age, this step is critical. The earlier you can start this step the better due to the compounding effect. Start with your company’s 401k plan and receive the full employer match. Invest the rest in Roth IRAs.

Baby step 5 – Begin college funding for kids.

No kids or your kids are fully grown? You can skip this step. Otherwise, its time to start researching and setting money aside for your kid’s future and their education. Why wait until after saving for retirement? For one, there are many ways to go to college without going into a large amount of debt. They can seek grants and scholarships, go to a local community college, or consider an in-state college. Also, your kids may or may not go to college – but you will retire. Putting your retirement first is not selfish; it’s wise.

“We buy things we don’t need with money we don’t have to impress people we don’t like.”

The Total Money Makeover by Dave Ramsey

Baby step 6 – Pay off your home.

By this step, your house mortgage is the only thing keeping you from being completely debt-free. Can you imagine a life with no mortgage payments? Any extra payments you can put toward your mortgage can save you tens (even thousands) of dollars in interest.

Baby step 7 – Continue to build wealth, giving and enjoying it at higher levels.

We save the most exciting step for last. Think of all the weight off your shoulders if you were debt-free! This is where legacies are built. Now is the time to buckle down, start thinking about your financial future and keep building wealth to leave an inheritance to your kids and their kids.”We buy things we don’t need with money we don’t have to impress people we don’t like.”

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.