Heading to college is one of the first times in your life where you have to be fully responsible for your finances.

Unfortunately, many students struggle to manage their finances while also enjoying themselves at college, but there are simple money management techniques that you can use to keep your finances healthy.

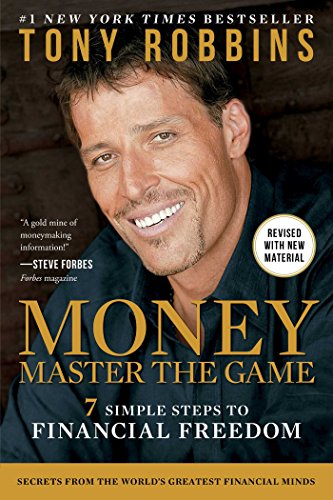

Money Master The Game

by Tony Robbins

⏱ 14 minutes reading time

🎧 Audio version available

Create a Weekly Budget

If you rarely check your bank account and suddenly realize you don’t have enough funds to get you through until the end of the month, it’s time to start budgeting. Creating a weekly budget is one of the simplest ways to regain control of your finances. At the start of the week, figure out how much you have to spend.

Start by taking off any of the non-negotiable expenses you have for the week, like rent or groceries, and then figure out how you’d like to spend the leftover money. While it’s great to have some money available to enjoy socializing or shopping, make sure you save some money for more significant purchases or summer break.

Save Up For Larger Purchases

While it can be tempting to stay up to date with the latest trends and have the same gadgets as your friends, make sure you think carefully about these more significant purchases. Don’t make impulsive decisions that you might regret, and instead, save up for a while first.

Then, when you are saving up for a new gadget, car, or vacation, you’ll have the time to think about whether this is really how you want to spend your money. Then, in a month or two that you are saving up, you may realize that this money is better spent elsewhere, which shows financial maturity and helps you avoid making regrettable decisions.

Get a Part-Time Job

Even if you feel relatively secure with your finances, it’s never too early to start saving for your future. While some courses make it impossible to take on a part-time job, if you have the time, consider thinking about working a day or two a week to earn a little extra cash.

You can put this money towards treating yourself each week, or you could use it to start saving up for a more significant purchase. Some students can put a down payment on a property shortly after graduating, which is part of their success.

When you graduate from college, you’ll find that you are under less pressure financially, which is something that any graduate appreciates when searching for their first post-college job.

Cook At Home

Although eating out is delicious and a great way to catch up with friends, try to avoid eating out every day. Cooking at home and meal prepping is one of the easiest ways for students to save money, and you’ll quickly notice the huge difference this makes to your bank balance.

On top of that, it’s usually much healthier to cook at home, and you’ll find that you can enjoy delicious meals without spending a fortune. So, once a week, take the time to meal prep so that you don’t have to worry about cooking after a busy day of studying. You can then reheat the meal in the evening.

Walk or Ride a Bike

While many students like to drive, we highly recommend walking or biking instead if you live on campus or can sacrifice your car. Both of these options won’t cost you anything, and even if you have to invest in a bike, it’s going to be far cheaper than maintaining a car in the long run.

As well as being a more affordable option, you’ll find that walking and biking are so much better for your health, keeping you feeling and looking better during your college years.

Don’t Buy New Textbooks

Some courses require a ridiculous amount of textbooks, for that reason, so always buy these pre-used. Then, when you head to sites like Amazon, you’ll have no trouble finding almost any book pre-used on there, and they will often be about half the price of a brand new book.

In addition, you are likely only going to use these books for a few months, and then once you are finished with them, you can relist them to get back some of the money to put towards your next set of books.

Take Advantage of Student Discounts

When you are a student, we recommend that you never leave the house without your student ID. Many shops and restaurants offer incredible discounts for students, which you’ll appreciate during your time at college.

When you are heading out to buy something you need or going for dinner with your friends, you’ll enjoy the small discount offered. There’s no reason you wouldn’t want to receive a discount on something you were going to buy anyway, so keep your ID with you. When making larger purchases, take the time to research websites and companies that offer student discounts, as you might be surprised by how beneficial these can be.

As you can see, there are many ways for students to manage their money more effectively. Although being a student can put a lot of pressure on your finances, you’ll find that you are much more aware of your spending by cutting back on unnecessary purchases and keeping track of your expenses.

The more control you have over your spending, the easier it will be to save money before you graduate. In addition, learning to look after your finances at this stage in your life will set you up for success later on and help you feel more secure about your future.

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.