Are you looking to diversify your investment portfolio and maximize your returns? Whether you’re a seasoned investor or just starting out, knowing the best assets to invest in can make a world of difference in your financial journey. Real estate and stocks are two popular investment options that have the potential to yield significant profits. However, with so many choices available, it can be overwhelming to determine where to invest your hard-earned money.

In this article, we have compiled the ultimate list of the best assets to invest in, from real estate to stocks and everything in between. We’ll explore the benefits and drawbacks of each investment option, as well as provide valuable insights and expert advice to help you make informed decisions. Whether you’re interested in investing in commercial properties, residential real estate, or the stock market, this comprehensive guide will give you the tools you need to succeed.

Stay tuned for our in-depth analysis of each asset class and discover the strategies that can lead to financial success. Get ready to take your investment game to the next level and build a diversified portfolio that can withstand market fluctuations. Let’s dive in and unlock the secrets to investing in the best assets!

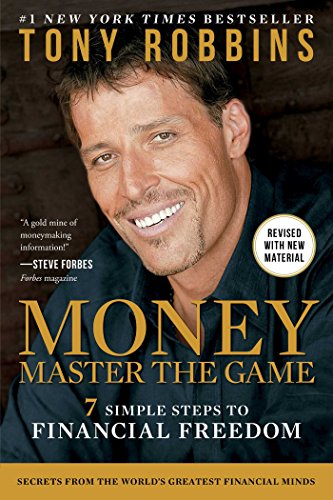

Money Master The Game

by Tony Robbins

⏱ 14 minutes reading time

🎧 Audio version available

Understanding different types of assets

Before we delve into the best assets to invest in, it’s essential to understand the different types of assets available. Assets can be broadly categorized into four main classes: real estate, stocks, bonds, commodities, and cryptocurrencies. Each asset class has its own unique characteristics and potential for returns.

Real estate, as an investment, offers the opportunity to generate rental income and take advantage of property appreciation. Whether it’s residential properties, commercial buildings, or even real estate investment trusts (REITs), real estate can provide a stable and tangible investment option. However, it also comes with its own set of challenges, such as property management and market fluctuations.

Stocks, on the other hand, represent ownership in a company and can provide potential capital appreciation and dividend income. Investing in stocks allows individuals to participate in the growth and success of well-established companies or emerging industries. It offers liquidity and the ability to diversify across different sectors and regions. However, stock investments are subject to market volatility and require careful analysis and research.

Bonds, or fixed-income securities, are debt instruments issued by

governments or corporations to raise capital. Investing in bonds provides a fixed interest income over a specified period, making it a popular choice for risk-averse investors seeking stable returns. However, bond investments are also subject to interest rate fluctuations and credit risks.

Commodities, such as gold, silver, oil, and agricultural products, represent tangible assets that can be traded on various exchanges. Investing in commodities can act as a hedge against inflation and provide diversification benefits to a portfolio. However, commodity prices can be volatile, influenced by factors such as supply and demand dynamics and geopolitical events.

Cryptocurrencies, the newest asset class, have gained significant attention in recent years. Digital currencies like Bitcoin and Ethereum offer decentralized peer-to-peer transactions and potential high returns. However, they also come with high volatility, regulatory uncertainties, and security risks. Investing in cryptocurrencies requires a deep understanding of the technology and market dynamics.

Real estate as an investment

Real estate has long been considered a reliable investment option due to its potential for passive income and capital appreciation. Investing in residential properties, for example, can provide a steady stream of rental income while benefiting from property value appreciation over time. Rental properties offer the advantage of leveraging other people’s money through mortgage financing, allowing investors to build equity and generate cash flow.

Commercial real estate, such as office buildings, retail spaces, and industrial properties, can provide higher rental yields and potentially significant capital gains. However, it requires a deeper understanding of market dynamics and tenant management. Real estate investment trusts (REITs) offer a way to invest in real estate without the need for direct property ownership, providing diversification and liquidity benefits.

While real estate can be a lucrative investment, it’s important to consider factors such as location, market conditions, property management, and financing options. Conducting thorough due diligence and working with experienced professionals can help mitigate risks and maximize returns in the real estate market.

Stocks as an investment

Investing in stocks allows individuals to become partial owners of publicly traded companies and participate in their growth and profits. Stocks offer the potential for capital appreciation as the company’s value increases over time. Additionally, many companies also distribute dividends, providing investors with regular income.

When investing in stocks, it’s crucial to conduct thorough research and analysis to identify companies with strong fundamentals, competitive advantages, and growth potential. Factors such as financial health, management team, industry trends, and valuation metrics should be considered. Diversification across different sectors and regions can help mitigate risk and optimize returns.

Investors can choose to invest in individual stocks or opt for exchange-traded funds (ETFs) and mutual funds for broader market exposure. ETFs offer the advantage of diversification and lower costs, while mutual funds are managed by professional fund managers who make investment decisions on behalf of investors.

Bonds as an investment

Bonds are fixed-income securities that pay interest over a specified period, making them a popular choice for risk-averse investors seeking stable returns. Government bonds, issued by national governments, are considered the safest form of bonds due to their low default risk. Corporate bonds, on the other hand, carry higher yields but also higher credit risks.

When investing in bonds, understanding factors such as credit rating, interest rate environment, and maturity dates is crucial. Bonds with longer maturities tend to offer higher interest rates but also carry higher interest rate risk. Investors can choose between individual bonds or bond funds, which provide diversification and professional management.

Commodities as an investment

Investing in commodities can act as a hedge against inflation and provide diversification benefits to an investment portfolio. Gold, for example, is often considered a safe haven asset during times of economic uncertainty. It has historically maintained its value and served as a store of wealth. Other commodities, such as oil and agricultural products, offer exposure to global supply and demand dynamics.

Investors can gain exposure to commodities through various means, including futures contracts, ETFs, and mutual funds. However, it’s important to note that commodity prices can be volatile and influenced by factors such as geopolitical events, weather conditions, and global economic trends.

Cryptocurrencies as an investment

Cryptocurrencies have emerged as a new asset class, offering decentralized peer-to-peer transactions and potential high returns. Bitcoin, the first and most well-known cryptocurrency, has seen significant price appreciation over the years. However, it’s important to note that cryptocurrencies are highly volatile and subject to regulatory uncertainties.

Investing in cryptocurrencies requires a deep understanding of the technology, market dynamics, and risk management strategies. Investors should carefully evaluate factors such as security measures, liquidity, and the credibility of the underlying blockchain technology. Diversification and investing only what one can afford to lose are key principles to consider when investing in cryptocurrencies.

Diversification: The key to successful investing

Building a diversified investment portfolio across different asset classes is essential to mitigate risks and optimize returns. Diversification helps spread investment risk and reduces the impact of market fluctuations on the overall portfolio. By allocating investments across various assets, such as real estate, stocks, bonds, commodities, and cryptocurrencies, investors can benefit from the unique characteristics and potential returns of each asset class.

Related: 11 Most Common Personal Money Management Mistakes People Make

Factors to consider when choosing assets to invest in

When choosing the best assets to invest in, several factors should be considered. These include the investor’s risk tolerance, investment goals, time horizon, and financial situation. Understanding one’s own risk appetite and aligning investments accordingly is crucial to avoid undue stress and potential losses.

Additionally, conducting thorough research, staying informed about market trends, and seeking expert advice can help investors make informed decisions. Working with financial advisors or investment professionals can provide valuable insights and guidance tailored to individual circumstances.

Finding the right investment mix for you

Investing in the right assets is key to building a successful investment portfolio. Real estate, stocks, bonds, commodities, and cryptocurrencies each offer unique opportunities and risks. By understanding the characteristics and potential returns of each asset class, investors can make informed decisions and build a diversified portfolio that can withstand market fluctuations.

Remember to conduct thorough research, seek expert advice, and align investments with your risk tolerance and financial goals. Investing is a long-term game, and patience and discipline are essential. With the right strategies and a well-diversified investment mix, you can maximize your returns and achieve financial success.

So, whether you’re interested in investing in real estate properties, exploring the stock market, or considering alternative assets like commodities or cryptocurrencies, the key is to stay informed, take calculated risks, and adapt to changing market conditions. Start your investment journey today and pave the way for a secure financial future.

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.