High dividend mutual funds make excellent investments. These are mutual funds that invest in stocks that pay dividends.

If you invest in these funds, you can reinvest the dividends into more shares. You can also use the money as an income stream. The strategy emphasizes stocks that pay significant dividend payments to generate income.

Investing in high dividend mutual funds allows investors to take advantage of several aspects of investing. It also gives them a chance to not rely solely on inherently volatile stock market prices.

But as with any investing strategy, mutual funds come with pros and cons.

Money Master The Game

by Tony Robbins

⏱ 14 minutes reading time

🎧 Audio version available

The Pros and Cons of Investing in High Dividend Mutual Funds

Pro # 1: Insulation from the Stock Market

One of the biggest advantages of high dividend mutual funds is the insulation from the stock market.

The stock market is unpredictable. The average investor simply does not have the knowledge or information that many institutional investors have to make the right moves.

They also don’t have the same ease of liquidity in their stock purchases.

Dividends do not fluctuate the same way as traditional stock market does. You simply have to find a company with a safe and reliable cash flow and a history of paying dividends. This will help you decide whether they will offer a high yield on your investment.

Pro # 2: Steady Income Stream

In Money – Master the Game, acclaimed author Tony Robbins advises his readers to build an umbrella fund while the weather is nice. Essentially, you should save as much as you can for retirement while you are still young.

Something that can make saving exponentially easy is creating multiple income streams. In this way, investing in high dividend mutual funds could become your financial umbrella.

This is because these funds are reliable to pursue portfolio growth. They are not subject to massively unpredictable fluctuations, such as those of the traditional stock market.

Pro # 3: Low Risk

High dividend mutual funds come with a low risk. This is achieved through the use of diversification, as most mutual funds will invest in anywhere from 50 to 200 different securities.

This lesson is reinforced in Tony Robbins’ book. Diversification is crucial to building a steady stream of income.

Con # 1: Low Returns

A downside to investing in high dividend mutual funds is the eventual cap on returns. The dividend stock may pay out a sizeable return, but despite being high yielding, they don’t usually pay out more than about 10% annually.

Con # 2: Potentially High Expense Ratios and Sales Charges

If you are not paying attention to the expense ratios and sales charges of high dividend mutual funds, your expenses may get out of hand. It’s best not to invest in funds with expense ratios greater than 1.50%. Incurring fees reduce the overall investment returns you receive.

Con # 3: Tax Inefficiency

When we compare dividend stocks with growth stocks, we find that dividends are taxed twice. This is known as double taxation.

First, they are taxed when the company paying the dividend earns money. The second time is when the investor receives their dividends.

Double taxation reduces the overall returns you get, reducing the overall profitability of high dividend mutual funds.

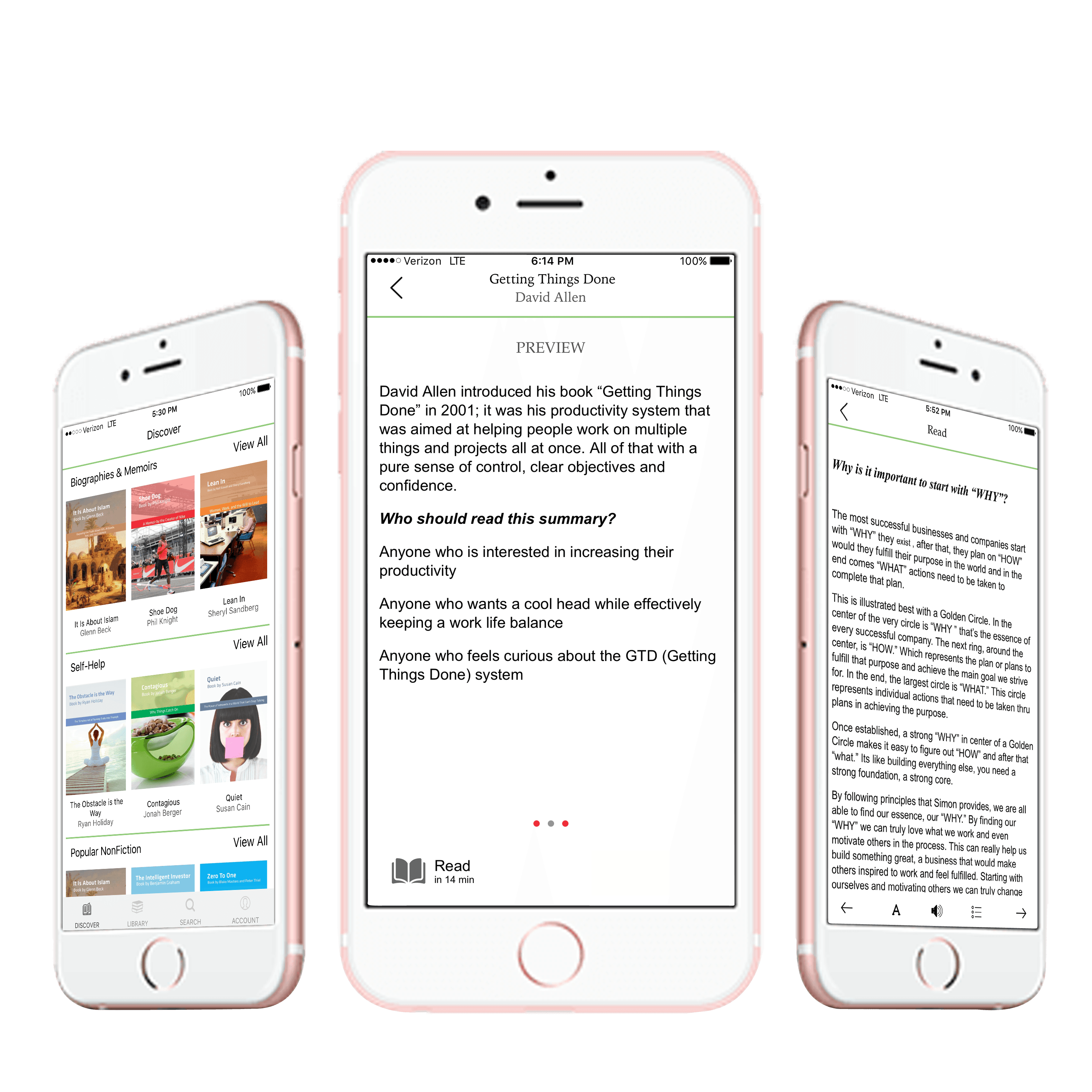

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.