When working with a limited budget, you might wonder what options are open to you as a beginner investor. The good news is there are many liquid funds on offer to beginner investors working with a tight budget. Today we’re going to share seven of the top liquid funds that we recommend you check out. Of course, you’ll want to ensure that the one you invest in is right for your personal situation, so take the time to discover more about these funds before investing.

The intelligent investor

by Benjamin Graham

⏱ 12 minutes reading time

🎧 Audio version available

Vanguard Total World Stock ETF

When looking for a good liquid fund to begin your investment journey, we highly recommend taking a look at the Vanguard Total World Stock ETF. It offers you the chance to trade on the worldwide market, and the portfolio is quite varied in the regions that it works in. You’ll be able to trade with over 40 countries, making this an exciting opportunity for first-time investors. Investors appreciate the diversification on offer from this fund, making it a good option for anyone who is new to this type of investing. You’ll find that their team is always on hand to support you and answer any questions you may have about working with a limited budget.

Fidelity Puritan Fund

This fund has been around for decades now, which is why it’s still a popular option for first-time investors. It’s a type of balanced fund, which offers good exposure to both bonds and stocks. As a well-established company, you’ll find that they offer the support you need to feel secure investing your limited funds into the Fidelity Puritan Fund. It often comes in as one of the top performers year after year, so you may find you get a good return on your investment when you invest wisely. Of course, you’ll want to do your research about any of the liquid funds we share here today to ensure it’s the best option for your money and future.

Fidelity ZERO Total Market Index Fund

Another fund to consider from Fidelity is their ZERO Total Market Index Fund. One of the reasons we recommend this to anyone with a limited budget is that there is no minimum investment associated with the fund. The expenses associated with trading aren’t much of a concern with this fund, making it a particularly beginner-friendly option. This fund invests in companies of all shapes and sizes, but the larger companies will naturally have more of an impact on its overall performance.

iShares Core S&P Small-Cap ETF

While you may think that investing in smaller companies is a risky move for a first-time investor with a limited budget, it’s still something we encourage you to consider. There are some risks associated with this move, but the profit in the long run can make it one of the smartest decisions you could make. This is one of the top funds within the US as far as smaller companies, offering you a great way to diversify your portfolio. It performs well year after year and is one we highly recommend you learn more about as you start your investment journey.

Vanguard Federal Money Market Fund

This is another strong product from Vanguard, which offers an accessible option for new investors. The expense ratio is relatively low, but keep in mind there is a minimum investment of $3,000. You’ll find that the majority of this fund is invested in cash and U.S. government securities, making it a good option for anyone who is new to this form of investing. Vanguard is well respected in the industry and takes care of its customers, so you’ll find that they are willing to answer your questions and offer the support you need when looking into this fund. Don’t be afraid to take the time as a first-time investor to ask any questions you have to avoid concerns and issues later on.

Invesco Government Money Market Fund

This is another fund that holds the majority of its assets in cash and government securities. The expense ratio is just 0.35%, making it a solid option for anyone working with a limited budget. You’ll find that you only have to invest $1,000 or $250 in an IRA, so it’s very accessible to those working with a small budget. Invesco is another well-trusted company in the industry, and you’ll find that its team is on hand at all times to support new investors. While you may be concerned about reaching out when working with a lower budget, don’t let this put you off from making your first investment this year.

Schwab US Dividend Equity ETF

The final option on our list is the Schwab US Dividend Equity ETF, which is known for its very low expenses. This fund tracks about 100 U.S. stocks, including well-known companies, such as PepsiCo and Pfizer. There are many restrictions on the type of companies that this fund will invest in, making it a safer option for anyone working with a low budget and investing for the first time. The expense ratio is just 0.06%, which is why we’d highly encourage you to consider this option if you are concerned about the risks of investing.

These are just seven of the best liquid funds for beginner investors working with a limited budget. Investing is a personal journey and one that we encourage you to think very carefully about before taking the first step. You’ll want to make sure that you are researching your options properly before making a move into the investing world, as you don’t want to be left in a difficult situation down the line. Each of these options are well worth looking into, but make sure you find the one that’s best for your current budget and needs to help you maximize your returns over the upcoming years after making your initial investment.

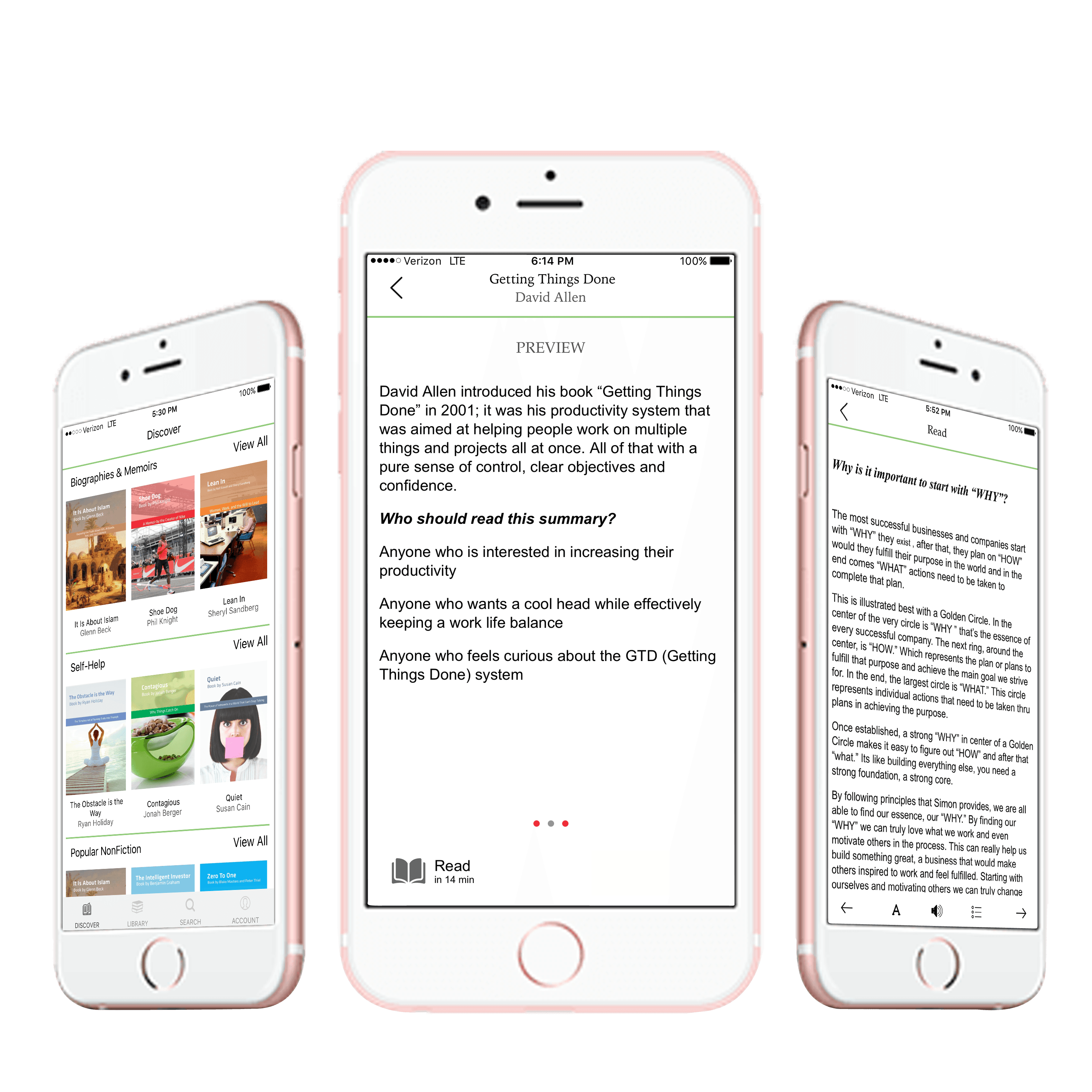

What Is Snapreads?

With the Snapreads app, you get the key insights from the best nonfiction books in minutes, not hours or days. Our experts transform these books into quick, memorable, easy-to-understand insights you can read when you have the time or listen to them on the go.